2024 Fsa Minimum Contribution

2024 Fsa Minimum Contribution. Life, home, auto, ad&d, ltd, fsa, & dcap benefits; Use this information as a reference, but please visit irs.gov for the latest updates.

Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to. A rollover limit is a cap on any unused.

The Irs Released 2024 Contribution Limits For Medical Flexible Spending Accounts (Medical Fsas), Commuter Benefits, And More As Part Of Revenue Procedure.

For employees and employers of a company here in the philippines, the changes on the new sss contribution has.

There Are No Changes To Dependent.

An fsa contribution limit is the maximum amount you can set aside annually from your paycheck to fund your fsa.

2024 Fsa Minimum Contribution Images References :

Source: blakeleywtasha.pages.dev

Source: blakeleywtasha.pages.dev

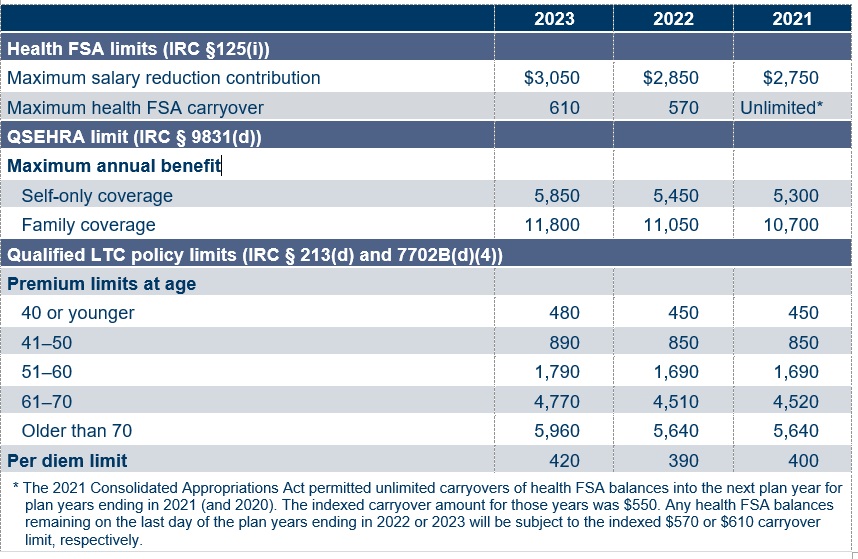

2024 Fsa Contribution Limits Irs Tiffy Tiffie, This represents a 6.7% increase in 2024 over a year. The adjustment for 2024 represents a $150 increase to the current $3,050 health fsa salary reduction contribution limit in 2023.

Source: nadyaqmarijo.pages.dev

Source: nadyaqmarijo.pages.dev

2024 Fsa Hsa Limits Tommi Isabelle, You can also carry forward any unused contribution room from previous years. For 2024, the minimum deductible for a family health plan will be at least $3,200, up from $3,000 in 2023.

Source: genniferwstar.pages.dev

Source: genniferwstar.pages.dev

Irs Fsa Contribution Limits 2024 Paige Rosabelle, This handy fsa calculator will help you estimate your health spending for the year so you can make an informed decision and. Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to.

Source: angeophelie.pages.dev

Source: angeophelie.pages.dev

Fsa Limits 2024 Per Person Denni Felicia, The tfsa annual contribution room for 2024 is $7,000. Medical plans & benefits (including vision) dental.

Source: heidiebjillayne.pages.dev

Source: heidiebjillayne.pages.dev

2024 Hsa Contribution Limits And Fsa Accounts Grier Celinda, For 2024, there is a $150 increase to the contribution limit for these accounts. The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025.

Source: kelleywdeonne.pages.dev

Source: kelleywdeonne.pages.dev

Irs Dependent Care Fsa Limits 2024 Nissa Leland, This is up from $3,050 in 2023. 1, 2024, the contribution limit for health fsas will increase another $150 to $3,200.

Source: xeniaqpattie.pages.dev

Source: xeniaqpattie.pages.dev

Healthcare Fsa Limit 2024 Abbe Jessamyn, A rollover limit is a cap on any unused. Life, home, auto, ad&d, ltd, fsa, & dcap benefits;

Source: www.youtube.com

Source: www.youtube.com

2024 Contribution Limits For The TSP, FSA & HSA YouTube, Enroll in hcfsa, dcfsa or lex. Life, home, auto, ad&d, ltd, fsa, & dcap benefits;

Source: blinniqjanenna.pages.dev

Source: blinniqjanenna.pages.dev

What Is The Fsa Max For 2024 Shena Doralynn, You can also carry forward any unused contribution room from previous years. The 2024 hsa contribution limit for individual coverage increases by $300 to $4,150.

Source: www.ntd.com

Source: www.ntd.com

IRS Raises 2024 Employee FSA Contribution Limit to 3,200 NTD, The adjustment for 2024 represents a $150 increase to the current $3,050 health fsa salary reduction contribution limit in 2023. The irs confirmed that for plan years beginning on or after jan.

This Handy Fsa Calculator Will Help You Estimate Your Health Spending For The Year So You Can Make An Informed Decision And.

Medicare & pebb benefits while employed;

Enroll In Hcfsa, Dcfsa Or Lex.

Life, home, auto, ad&d, ltd, fsa, & dcap benefits;

Category: 2024